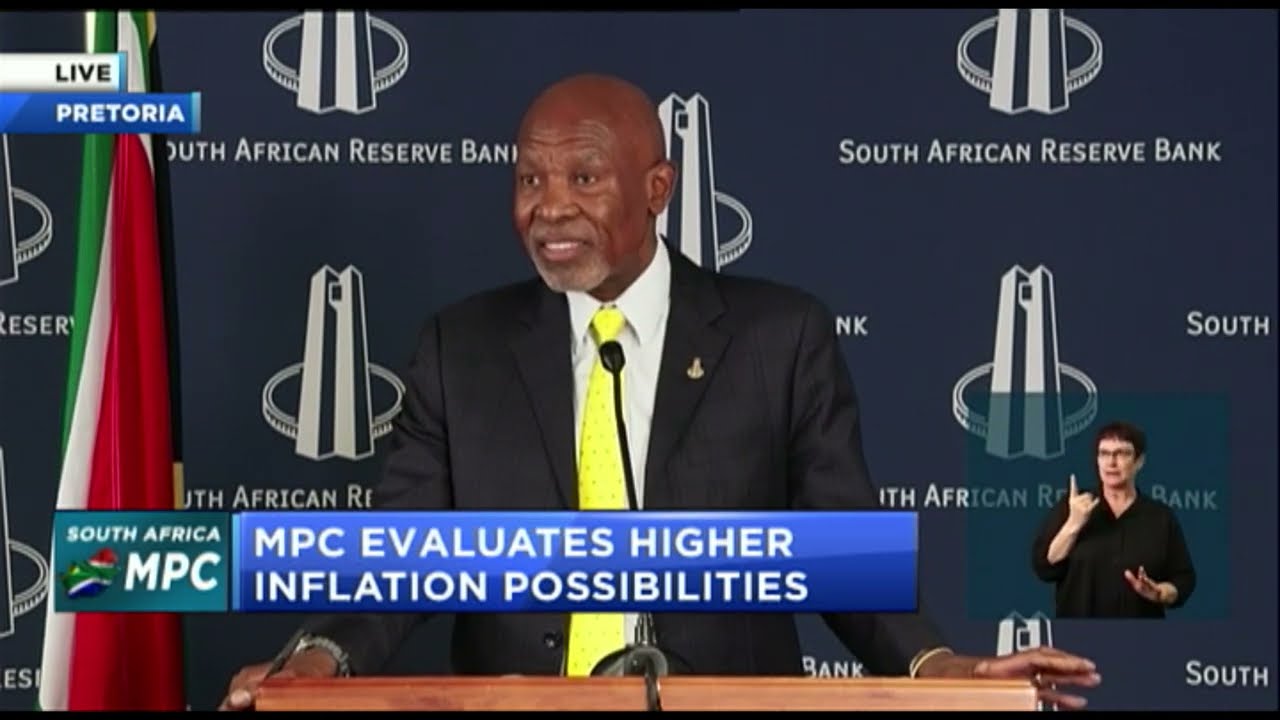

- Governor Lesetja Kganyago revealed that the South African Reserve Bank (SARB) has cut the interest rate by 25 basis points.

- This brings the interest rate down to 8%, aligning with predictions made by economists just hours before the announcement.

- Social media users weren’t exactly thrilled, with many accusing the SARB of mimicking the U.S. Federal Reserve's actions.

Tebogo Mokwena, a seasoned current affairs journalist with Briefly News, has spent seven years covering economic, financial, banking, and state-owned enterprise matters for Daily Sun and Vutivi Business News.

JOHANNESBURG — Listen up, folks. The South African Reserve Bank just dropped a big announcement: they’ve lowered the interest rate by 25 basis points. Now, here’s the kicker — many South Africans were hoping for a much bigger cut, at least 50 basis points or more. But the bank had other plans, and the reaction online has been, well, let’s just say, less than enthusiastic.

What Happened at the SARB?

The news broke when @Newzroom405 shared a video of Governor Lesetja Kganyago making the official announcement. Economists had been whispering that a 25 basis point reduction was on the table, and it turns out they were spot on. Kganyago explained that the Monetary Policy Committee (MPC) decided to ease the policy rate by exactly 25 basis points, bringing the interest rate down to 8%. This adjustment will officially take effect starting September 20, 2024. So, what does all this mean for the average South African? Let’s dive in.

Read also:Big Wins In South Africas Latest Lotto Draw

“In our discussions, the MPC considered three options: keeping the rate unchanged, cutting it by 25 basis points, or cutting it by 50 basis points. After much deliberation, we reached a consensus on the 25 basis point reduction. Why? Because a slightly less restrictive monetary policy aligns with our goal of achieving sustainable, lower inflation over the medium term.”

If you missed it, you can check out the full announcement right here:

South Africans Sound Off

As you can imagine, the news didn’t go down smoothly with everyone. Social media lit up with reactions from all corners of the country. Some people were downright frustrated, accusing the SARB of simply following in the footsteps of the U.S. Federal Reserve. Others felt that the decision didn’t address the financial struggles many South Africans are facing. Let’s hear what some of them had to say:

One user, Mushavhi, wasn’t shy about voicing their opinion:

“No backbone here, just blindly following the USA. Where’s the independence in this decision?”

FSD chimed in with their perspective:

“It’s clear who’s really in charge — the ones who control the interest rates. This feels more like a puppet show than real financial leadership.”

Ayanda M threw in a question that many others were likely pondering:

“Why not match the Fed’s 50 basis point cut? What’s holding us back from making a bolder move?”

Sir Jay added a touch of humor to the conversation:

Read also:Tina Jaxa Set To Star In Exciting New Historical Series

“Today, he’s not shouting because he’s cutting. Maybe next time, he’ll shout for a bigger cut!”

Braleather summed up the concerns of many with a pointed question:

“What’s a measly 25 basis points going to do for our financial burdens? This feels like a token gesture rather than real relief.”

And finally, West to West voiced a broader critique:

“A foreign-owned Reserve Bank is a roadblock in our already fragile economic climate. We need solutions tailored to our unique challenges, not copy-pasted strategies.”

Repo Rate Hikes in 2023: A Quick Look Back

It’s worth noting that this isn’t the first time the SARB has made waves with its interest rate decisions. In 2023, the bank hiked the repo rate by a whopping 50 basis points, surprising many economists who had expected a smaller increase. The impact on South Africans’ wallets was significant, with many feeling the pinch as loan repayments and other costs rose. This history adds context to the current frustrations, as people hoped for a more substantial cut this time around to help ease the financial strain.