- A local man opened up about his paycheck, revealing he takes home less than R500 after deductions.

- His deductions included a home loan, garnishee orders, medical aid, and payments to financial services companies.

- Social media users were split—some sympathized, while others offered practical advice on what he could do next.

- Briefly News consulted a financial advisor for insights into how this situation could be improved.

For many South Africans, payday can feel bittersweet when a chunk of your hard-earned cash disappears before it even hits your account. Recently, a man named Sbongiseni Mdima sparked widespread conversation after sharing a shocking glimpse of his payslip on TikTok. After all the deductions, he was left with less than R500. Let’s dive deeper into his story and explore what can be done in situations like this.

When Deductions Leave You With Pennies

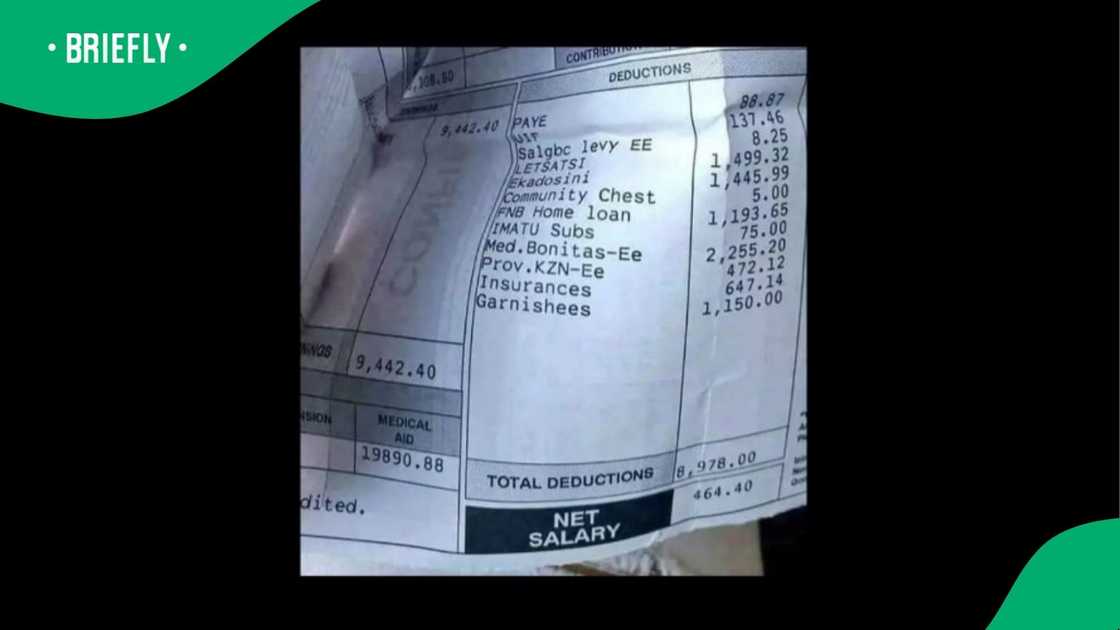

Sbongiseni Mdima, a TikTok user (@sbongiseni_mdima), recently shared a screenshot of his post-deduction salary. While he didn’t disclose his gross pay, the image painted a clear picture of financial strain. His deductions weren’t just the usual suspects; they included a home loan from FNB, medical aid, garnishee orders, and fees to a financial services company called Letsatsi.

It’s not uncommon for South Africans to face hefty deductions, but Sbongiseni’s case has resonated deeply with people who understand the struggle of watching their paycheck dwindle to almost nothing. Here’s a closer look at the deductions:

Read also:Lehasas Uncle Plans To Pay Lobola For Pretty While He Serves Time

Expert Advice: What Can Be Done?

To better understand Sbongiseni’s predicament, Briefly News reached out to Walter De Wet, a seasoned financial advisor with Mzingisi Brokers. Walter offered some actionable advice for Sbongiseni and others in similar situations:

"It’s true that there’s not much you can do to directly increase net pay, but you can review and possibly stop certain deductions. For instance, if there are fees to a financial services provider (FSP), consider pausing them temporarily. Once your financial situation stabilizes, you can reintroduce those payments."

Mzansi Weighs In: Mixed Reactions Online

Sbongiseni’s post quickly went viral, sparking heated debates in the comments section. Some users expressed empathy, while others offered practical solutions. The reactions were as varied as the people commenting:

@right_funani chimed in with a poignant observation:

"Being employed can feel like being in jail, especially when you can’t manage the little you earn."

@oarabilethati3 offered a straightforward solution:

"Apply for debt review. You’ll be okay."

@amakaawande had reservations about debt review, suggesting an alternative approach:

Read also:Rulani Mokwenas Age Debate Fans React To Rare Teen Photo

"No, don’t apply for debt review—it gives you little control over your bank account. Consider switching to a more affordable medical aid plan. Also, try negotiating with companies like Letsatsi and Ekadosini. A consolidation loan might help lower your monthly payments, though it could extend the term and increase interest rates."

@goodie141 seemed confused by the payslip itself:

"That payslip doesn’t add up. Something doesn’t seem right."

@christo.vos suggested starting a side hustle:

"It’s time to think about starting a small business on the side. What can you buy with R460? You can’t even afford to commute to work with that amount."

@sabzangubane53 echoed the sentiments of many who’ve seen similar cases:

"I’ve encountered payslips like this during my time as a financial advisor. It’s a harsh reality and truly heartbreaking."

Another Story: A Woman’s Confusing Payslip

Sbongiseni isn’t the only one sparking conversations about payslips. In another viral TikTok moment, a young woman shared her payslip after tax deductions. Her net pay left many scratching their heads, prompting viewers to advise her to double-check her tax code. It’s clear that financial transparency and education are crucial in helping individuals navigate these challenges.

Final Thoughts

Sbongiseni’s story is a powerful reminder of the financial struggles faced by many South Africans. While there’s no one-size-fits-all solution, seeking professional advice, exploring debt relief options, and considering side hustles can make a significant difference. If you or someone you know is in a similar situation, remember that help is available—and sometimes, all it takes is a fresh perspective to turn things around.