Let’s be real, creatives: numbers can feel like an alien language when you’re more into colors, designs, or storytelling. But guess what? Accounting for creatives isn’t as scary as it sounds. Whether you’re a freelance graphic designer, an indie musician, or a writer chasing deadlines, understanding how to manage your finances is a game-changer. It’s not just about paying taxes—it’s about making sure you’re set up for long-term success.

Here’s the deal: if you’re like most creatives, you probably spent more time thinking about your next big project than crunching numbers. But here’s the thing—your financial health matters just as much as your creative output. Accounting for creatives is all about finding that sweet spot where creativity meets practicality. It’s about turning your passion into profit without losing your soul in the process.

Now, don’t get me wrong—I’m not here to turn you into a CPA overnight. What I am here to do is simplify the process and show you how to take control of your money. Because let’s face it, you didn’t become an artist to deal with spreadsheets, but you’ll thank yourself later when you’ve got your finances in check. So grab a coffee, and let’s dive in!

Read also:Brandon Sklenars Love Life A Closer Look At His Relationships

Why Accounting for Creatives Matters

Understanding the Creative Financial Landscape

As a creative, your income might look a little… unconventional. One month you’re rolling in cash from a big client project, and the next you’re wondering if you’ll make rent. That’s where accounting for creatives comes in. It’s like having a map to navigate the ups and downs of your financial journey.

Here’s what makes it tricky: traditional accounting methods don’t always fit the creative mold. You’re dealing with irregular income, freelance gigs, and sometimes even bartering services. But fear not—there are systems designed specifically for creatives that can help you keep track of everything without losing your mind.

Some key stats to keep in mind: according to the Freelancers Union, over 57 million Americans are freelancers, and a significant portion of them struggle with financial management. Don’t let that be you. With the right tools and mindset, you can thrive financially while still pursuing your dreams.

Key Challenges Creatives Face with Accounting

Irregular Income and Cash Flow Management

Let’s talk about the elephant in the room: irregular income. One of the biggest challenges creatives face is figuring out how to manage cash flow when money doesn’t come in at regular intervals. It’s not uncommon to have months where you’re flush with cash, followed by months where things are tight. So, how do you handle it?

First, create a buffer. Think of it as your financial safety net. Set aside a portion of your income during the good months to tide you over during the lean ones. This might sound simple, but trust me, it’s a lifesaver. Second, consider invoicing strategies. For example, you could ask for a deposit upfront or break payments into milestones. This way, you’re not left hanging when the project wraps up.

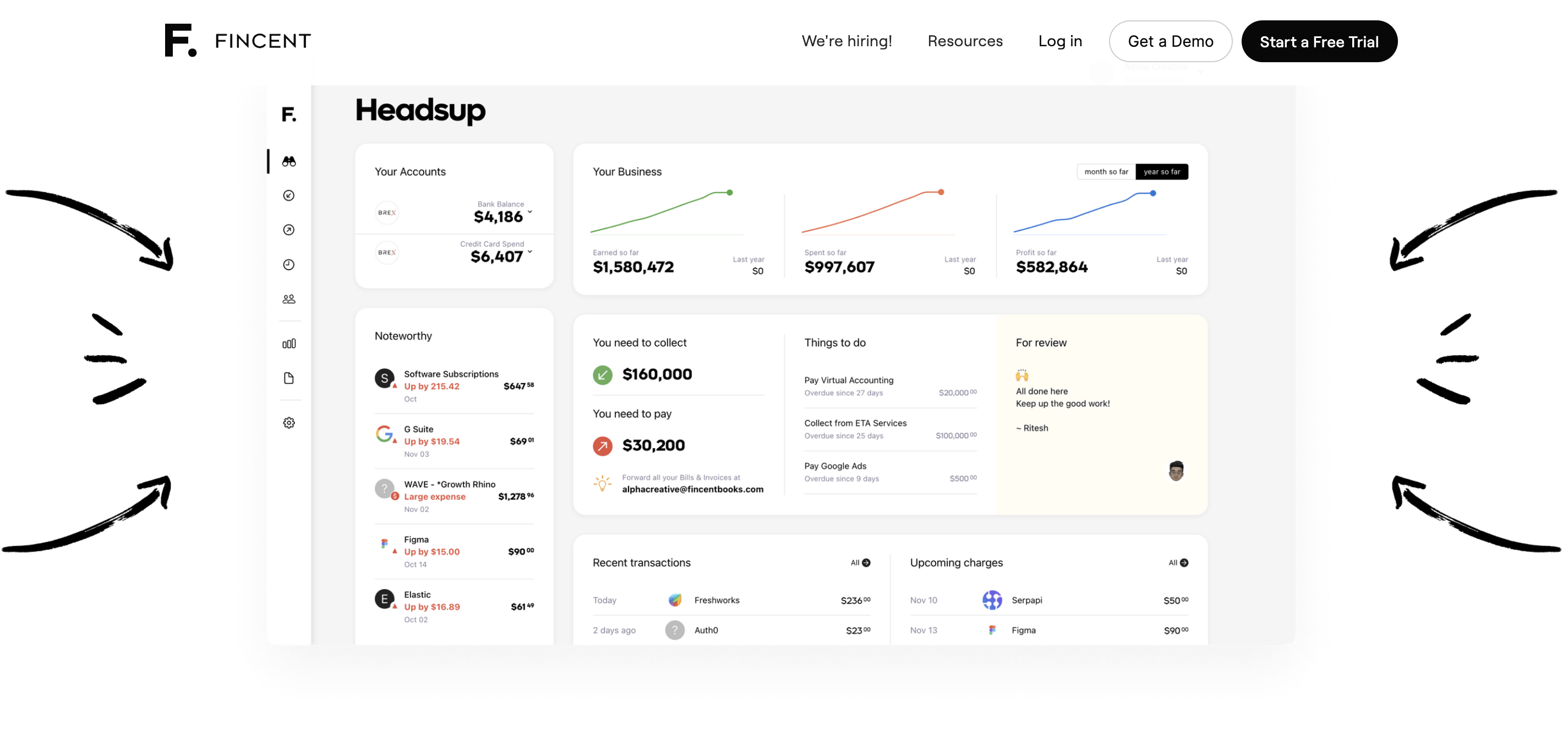

Pro tip: use tools like Wave or FreshBooks to help you manage invoices and payments. They’re user-friendly and designed for freelancers and small business owners. Plus, they integrate seamlessly with your accounting system, saving you time and hassle.

Read also:A South African Gogos Jawdropping Transformation Thats Got Everyone Talking

Setting Up Your Financial System

Choosing the Right Accounting Tools

Now that we’ve talked about the challenges, let’s focus on solutions. The first step in mastering accounting for creatives is setting up a solid financial system. This includes choosing the right tools to help you stay organized and on top of your game.

Here’s a quick rundown of some popular accounting tools for creatives:

- QuickBooks: Great for tracking expenses, invoicing, and tax preparation.

- Xero: Offers real-time financial insights and integrates with many apps.

- Wave: A free option that’s perfect for freelancers just starting out.

- Freelancer’s Union: Offers resources and tools specifically for freelancers.

Remember, the best tool is the one you’ll actually use. Don’t feel pressured to go with the fanciest option if it doesn’t fit your workflow. Simplicity is key when it comes to accounting for creatives.

Tracking Expenses Like a Pro

Identifying Deductible Business Expenses

One of the biggest perks of being self-employed is the ability to deduct business expenses from your taxes. But here’s the catch: you need to keep track of everything. From coffee shop meetings to art supplies, every little expense adds up.

Here’s a list of common deductible expenses for creatives:

- Office supplies

- Travel expenses

- Software subscriptions

- Marketing costs

- Equipment rentals

Pro tip: use an app like Expensify or Shoeboxed to track your receipts automatically. These tools will save you hours of manual entry and ensure you don’t miss out on any deductions come tax season.

Tax Planning for Creatives

Understanding Your Tax Obligations

Taxes are probably one of the least fun parts of being a creative entrepreneur, but they’re a necessary evil. The good news is that with a little planning, you can minimize your tax burden and avoid any unpleasant surprises.

First, familiarize yourself with the tax laws in your country. For example, in the U.S., freelancers are required to pay self-employment taxes in addition to income taxes. This means setting aside a portion of your income throughout the year to cover your tax obligations.

Second, consider working with a tax professional who specializes in creative industries. They can help you identify deductions, plan for quarterly taxes, and ensure you’re compliant with all regulations. It’s an investment that will pay off in the long run.

Building a Budget That Works

Crafting a Sustainable Financial Plan

Budgeting might sound boring, but it’s one of the most powerful tools in your financial arsenal. A well-crafted budget can help you stay on track, save for the future, and even splurge on that dream vacation you’ve been eyeing.

Start by breaking down your monthly expenses into fixed and variable categories. Fixed expenses include things like rent, utilities, and insurance, while variable expenses include groceries, entertainment, and unexpected costs. Once you’ve got a clear picture of your spending habits, you can start allocating your income accordingly.

Pro tip: use the 50/30/20 rule as a guideline. Allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. Adjust the percentages as needed to fit your unique situation.

Investing in Your Future

Saving and Planning for Retirement

Retirement might seem like a distant dream when you’re in the thick of your creative career, but it’s never too early to start planning. As a freelancer, you don’t have the luxury of an employer-sponsored retirement plan, but there are still plenty of options available to you.

Consider setting up a Solo 401(k) or an IRA. These accounts offer tax advantages and allow you to save for retirement while reducing your taxable income. Plus, many financial institutions offer tools and resources to help you manage your investments.

Pro tip: automate your contributions. Set up a recurring transfer from your bank account to your retirement account to ensure you’re consistently saving for the future.

Maximizing Your Income

Exploring New Revenue Streams

As a creative, you’re not limited to one source of income. There are countless ways to monetize your skills and expand your revenue streams. Whether it’s teaching workshops, selling merchandise, or offering consulting services, the possibilities are endless.

Here are a few ideas to get you started:

- Create digital products like e-books or printables.

- Offer online courses or coaching services.

- Partner with brands for sponsored content.

- Sell your art or designs on platforms like Etsy or Redbubble.

Pro tip: diversify your income streams to reduce risk. If one source dries up, you’ll still have others to fall back on.

Staying Motivated and Accountable

Building Healthy Financial Habits

Accounting for creatives isn’t a one-time task—it’s an ongoing process. To stay on top of your finances, you need to build healthy habits that become second nature. Start by setting aside a specific time each week to review your accounts, pay bills, and update your records.

Another great way to stay motivated is to find an accountability partner. This could be a fellow creative, a mentor, or even a financial coach. Having someone to check in with regularly can help you stay focused and committed to your goals.

Pro tip: celebrate your financial wins, no matter how small. Whether it’s paying off a debt or landing a big client, take a moment to acknowledge your progress and reward yourself.

Conclusion: Taking Control of Your Financial Future

Accounting for creatives doesn’t have to be overwhelming. By understanding the challenges, setting up the right systems, and staying consistent, you can take control of your financial future and thrive both creatively and financially.

So, what’s next? Start by implementing one or two of the tips we’ve covered today. Whether it’s setting up a budget, tracking your expenses, or exploring new revenue streams, every step you take brings you closer to financial freedom.

And don’t forget to share this article with your creative friends! Together, we can demystify accounting and empower each other to succeed. Let’s turn those numbers into opportunities and watch our creative careers soar.

Table of Contents

- Why Accounting for Creatives Matters

- Key Challenges Creatives Face with Accounting

- Setting Up Your Financial System

- Tracking Expenses Like a Pro

- Tax Planning for Creatives

- Building a Budget That Works

- Investing in Your Future

- Maximizing Your Income

- Staying Motivated and Accountable

- Conclusion: Taking Control of Your Financial Future